For some couples, February might be the month for romantic connection - celebrating Valentine's Day with dinner reservations or romantic gifting. For others, solidarity and closeness can be found in boycotting cupid together. Regardless of whether you have a love or hate relationship with the cherubic matchmaker who wields heart-tipped arrows, one thing is certain: cohabiting couples will enjoy a more harmonious relationship when they align on money matters.

Finance may not be the most romantic conversation topic, but it’s inarguably an important one. A 2021 Fidelity Investments Couples & Money Study found that one in five couples cite money as their greatest relationship challenge and 44% of partners admit to arguing about money occasionally. Building up emergency savings, paying off debt, and saving for milestone events (like college or a new home) topped the list of concerns keeping partners awake at night. So, what’s the best way to foster financial unity on the home front? We’ve come up with some suggestions we hope you’ll find helpful.

Skip The Candy; Talk Candidly

If you want to be successful in managing your money, you must find comfort in talking first. Being transparent about your earning, debt, and money philosophies may feel uncomfortable, but full disclosure is critical when it comes to making joint financial decisions like whether you want to merge finances or how you want to tackle bills. Make check-ins a regular conversation (versus a one-time event) so that when financial hurdles happen, you'll already have a baseline sense of how your partner will want to move forward.

Create Joint Financial Goals

What do you want to achieve as a couple? Do you need to create an emergency fund or start saving for a home purchase? Do you need to budget for an upcoming vacation or pay off a high interest credit card this year? Narrow down the primary financial priorities you can tackle in tandem, and then decide how you want those goals to be reflected: as a shared document you periodically refer to? As a vision board?? As categories within financial app? Everyone has their own preferences; the importance here is finding common ground when it comes to money milestones.

Organize Accounts

If your money philosophies are aligned and you generally see eye-to-eye, congratulations! Who spends what is half the battle. On the other hand, if fully merging finances is a pain point, consider keeping three accounts: one for you, one for your partner, and one for joint spending. Decide what falls under the shared category. For example, will medical expenses and gifts for family be shared or separate? Take time to fine-tune what constitutes "mine," "yours" and "ours," (and how much you want to budget within those categories) so that discretionary spending doesn't feel like something either of you need to defend.

Track Your Spending and Savings

Once your accounts are organized accordingly, there are several options for syncing up finances. Consider one of these popular options all offering free versions:

- Mint: tracks income, savings goals, and your credit score, and also syncs with your credit cards and checking/savings accounts

- Honeydue: Ideal for couples who appreciate the ability to chat about bills and transactions within the app (versus at the dinner table).

- Goodbudget: A good opinion for curbing spending. Acts as an "envelope system" in which you can only spend the amount that's in each designated envelope (you can have up to 20 envelopes before switching to the paid version).

Planning For Your Future

Need a little guidance when it comes to planning your finances or creating a realistic household budget? Our partner GreenPath Financial Wellness works with thousands of people each month to help them pay down debt, improve their credit, and achieve their goals.

This article is shared by our partners at GreenPath Financial Wellness, a trusted national non-profit

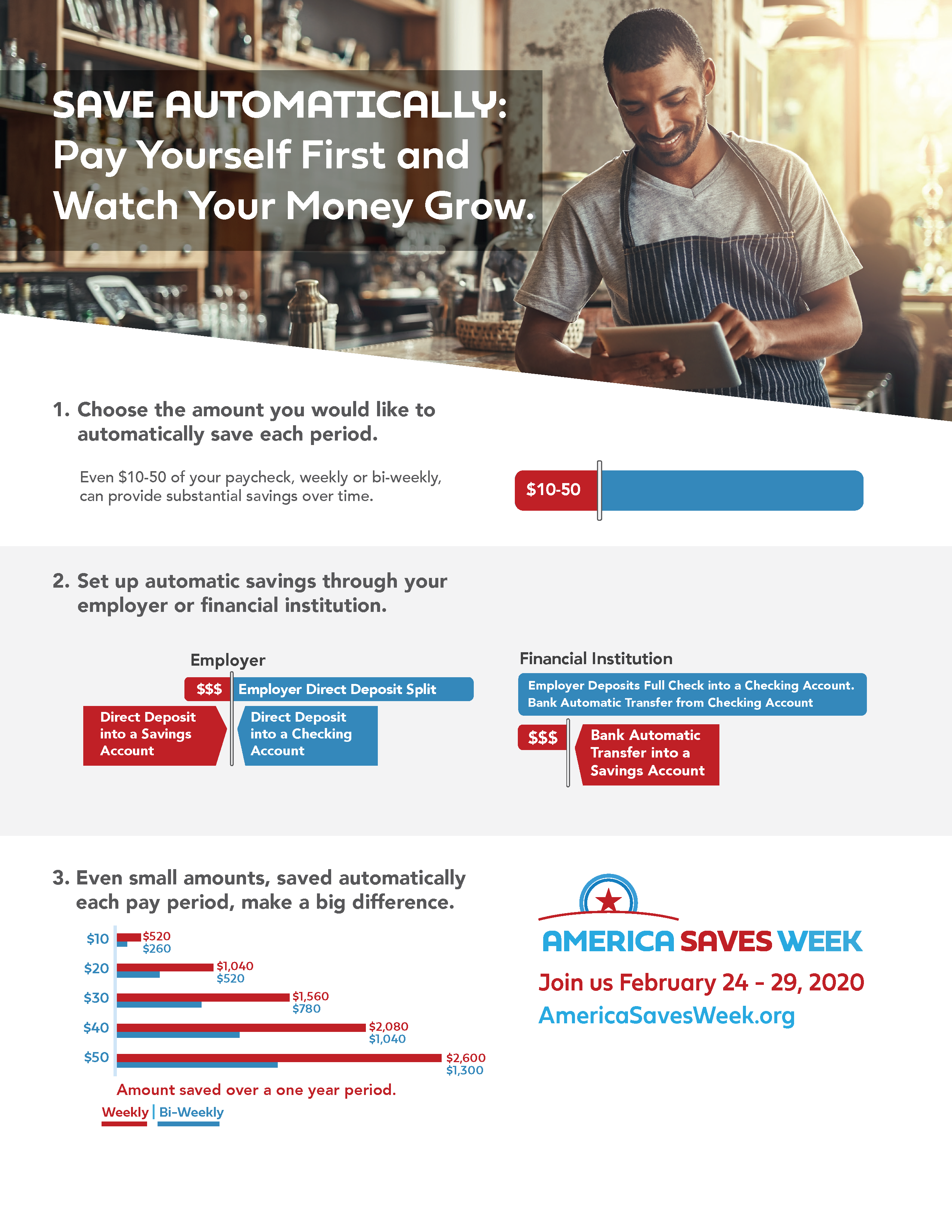

How do you save automatically? The two best ways to

How do you save automatically? The two best ways to