New Year’s resolutions are a mixed bag for many of us. On the one hand: personal betterment! On the other hand: methodical auditing of our refrigerator, checking account, and various vices. On the cusp of a fresh calendar year, we feel compelled to immediately transform our lives, but—as is the case with most good things—change takes time. This is especially true when it comes to financial goals. And in the aftermath of steep holiday spending, our goalposts can feel...far away.

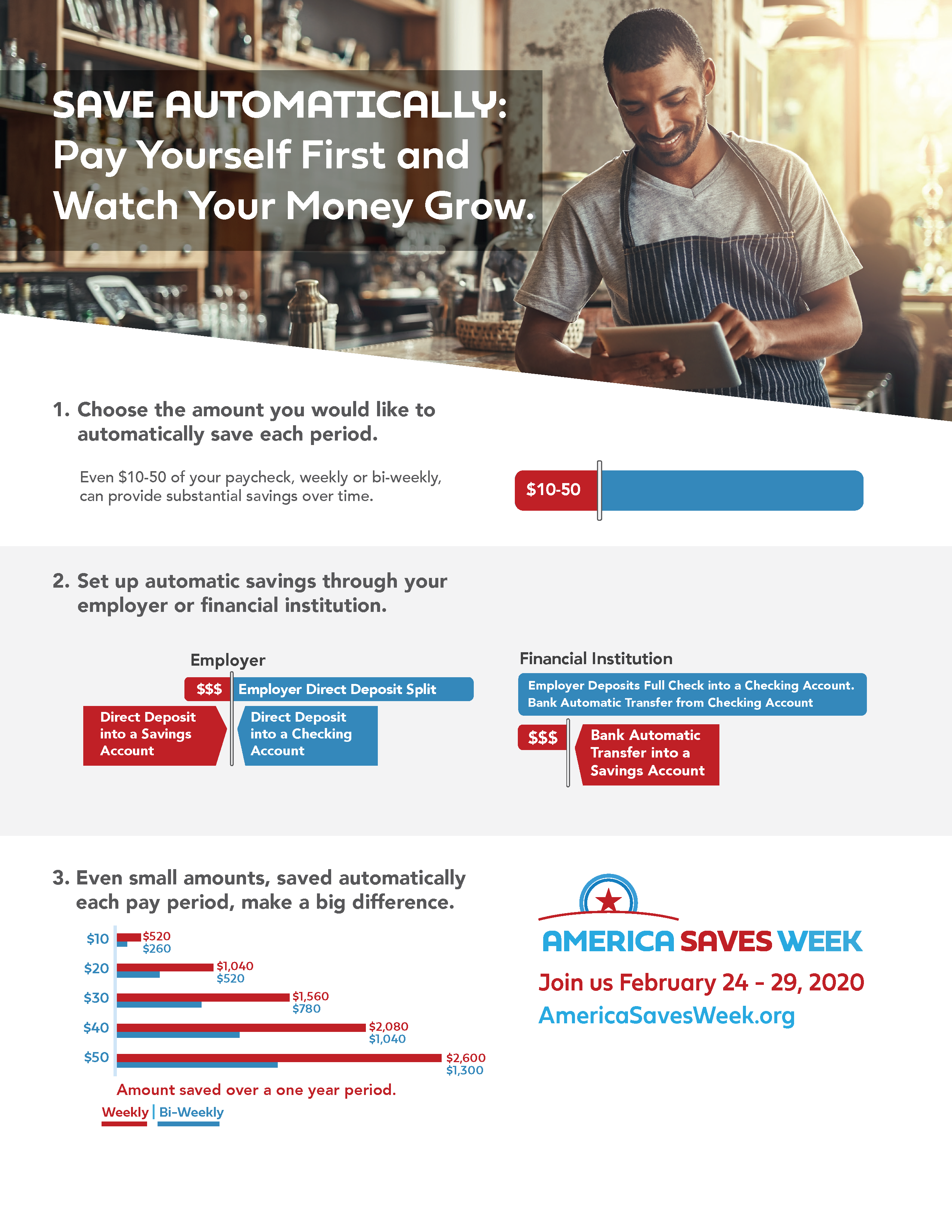

Automate Your Savings.

Enroll In A 401(k).

Trim Subscriptions

Check Your Credit Report.

You can get a free report once a year from each of the three major consumer reporting companies (Equifax, Experian, and TransUnion.) This allows you to resolve errors or instances of identity theft—red flags you do not want creditors looking at when they are evaluating your application for loans and credit cards. With the exception of Experian, you will have to pay a fee if you want to see your credit score. There is often a way around this, as more than 170 financial institutions and 10 of the top credit card issuers provide free access to your FICO score (the most commonly used type of credit score).

How to Get Your Free Credit Report.

The Fair and Accurate Credit Transactions Act of 2003 (FACT Act) entitles you to receive a free copy of your credit report once a year from each of the reporting companies – Equifax, Experian, and TransUnion. The three companies have set up one central website, toll-free telephone number, and mailing address. You can request your free report either online, by phone or even mail by visiting www.AnnualCreditReport.com or calling 1-877-322-8228.

How do you save automatically? The two best ways to

How do you save automatically? The two best ways to