Determining the best mortgage loan option is tough. You have to select a lender, choose between fixed and adjustable, and most importantly, choose the term in which you want and can pay for.

A 30 year fixed mortgage loan is usually typical but, there are other options. You can choose to pay off your loan faster with terms such as 20, 15 and even 10 year loans.

But, what are some of the advantages of shorter term loans?

- Pay off your home faster. The biggest advantage of a shorter term mortgage is that it can help you pay off your home much faster than the typical 30-year fixed mortgage. Your payment is significantly higher so you want to make sure that you can safely afford it before committing to a loan of this type.

- Pay less in interest. You'll pay significantly less interest over time not only because the interest rate is lower than a 30-year fixed loan, but also because you're borrowing the money for fewer years.

- Build equity faster. Shorter term loans can build equity at a much faster pace than traditional 30 year loans. It minimizes the interest you pay during the term of the mortgage and your interest rate should be lower.

A shorter term home loan is the right mortgage for people who want to pay off their mortgage as quickly as possible and who have the income to safely do it.

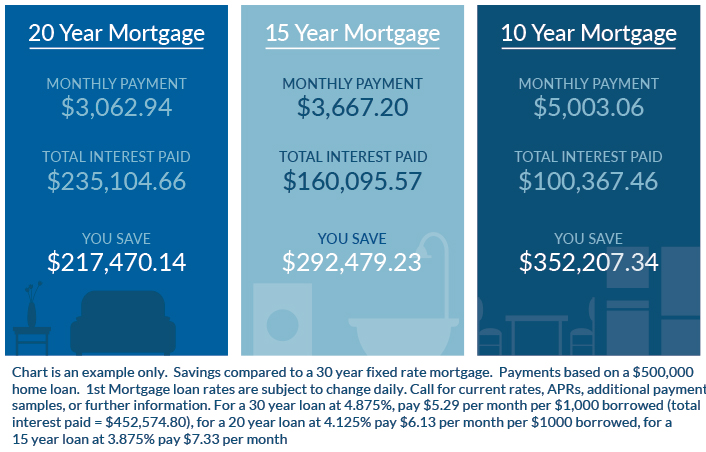

Savings Example Over The Life of The Loan

What are the disadvantages of shorter term fixed mortgages?

One disadvantage of shorter terms is that the monthly payment is much higher than a loan with a longer term. Because the monthly payment is so much higher, it could lower the amount of mortgage you may be able to afford.

Buying or refinancing a home is a big decision. No matter what you decide, it's important to know your options and choose what's best for you.

Click here to learn more about SafeAmerica Credit Unions home buying and refinancing options or give us a call at (800) 972-0999.