Shopping online during the holiday season is extremely convenient, so long as you don't fall victim to any of the 12 Scams of Christmas.

Thanksgiving has successfully served as a great distraction from the “New Normal” we have been dealt with. The good thing about the holiday season is having major holidays back to back with a short intermission in between. During this intermission, many take the time to try and finalize their holiday shopping before reuniting with their family and loved ones. Finding the best deals used to be about leaving to your favorite department store to “beat the lines”. Remember a time when people would camp outside of stores for Black Friday deals? Unfortunately with the sudden change in times due to uncontrollable forces, society has pivoted to increasing its use of smart devices/computers to complete transactions which would usually be done in a physical location.

Need a meal? You can get one delivered to you that isn’t pizza. Need groceries? You can get that delivered too, and so on. Retailers have had to adjust in the same manner as the food industry, to accommodate the demands of consumers. While it’s always great to see companies changing their processes to better serve their customers, many scammers are taking advantage of the multiple trends currently present, to attempt to fool shoppers into sending them money or valuable items.

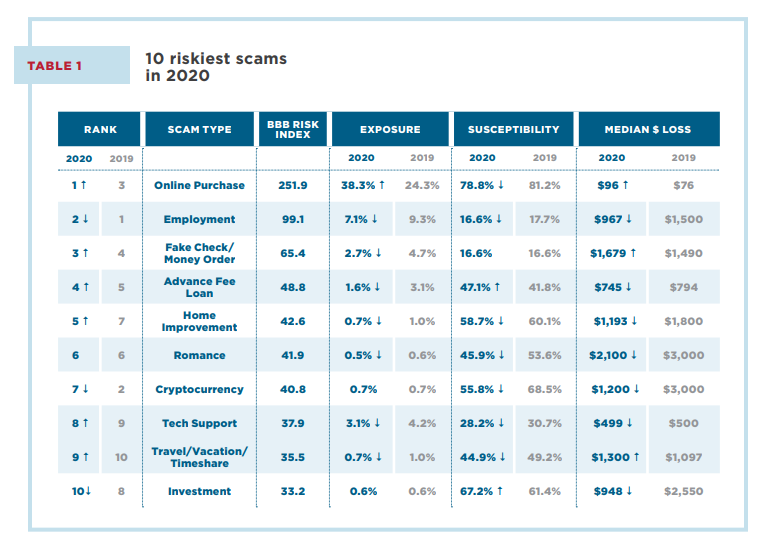

Based on the Better Business Bureau (BBB) Risk Index and reports submitted to BBB Scam Tracker in 2020, the 10 riskiest scams listed in Table 1 pose the most significant risks to consumers.

The current affairs of what has happened throughout the Bay Area and Los Angeles has further encouraged shoppers to shop online and with this, an increase probability of coming across a scam online. Scammers are using the social pressure of getting the best “deal” to have distracted consumers easily fall into their online traps. As mentioned before in blogs from earlier days of the pandemic, scamming activity has increased dramatically since March of 2020 and the holiday season is a feeding frenzy for scammers everywhere.

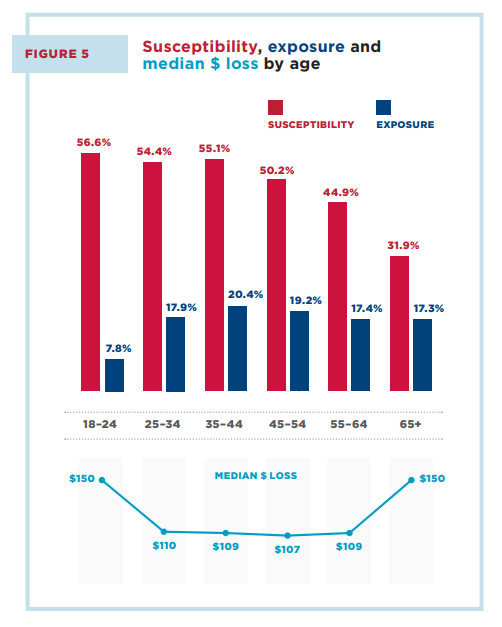

People ages 18-24 had the same median dollar loss ($150) as that of ages 65+ ($150) (Figure 5).

Below is a list of 12 trends the BBB has compiled to help inform consumers of the malpractices used to steal from people who are online.

1. Misleading Social Media Advertisements

After tailoring in their target demographics, scammers have been posing as small businesses and/or charities to win over consumers through an emotional tie-in. When consumers “buy” their goods, they are often reported to the BBB to receive counterfeit goods or even unwanted reoccurring charges for “free trial offers”. You can read more about misleading ads here: Misleading Ads

2. Social Media Gift Exchanges

Gift exchanges have always seem to work best in person, but with everything switching over to online, an online gift exchange seems doable right? Well, there are a few going through the internet that state if you send one gift, you could receive up to 36! As most can share, if it sounds too good to be true, it most likely is NOT true. This scam works like this: A friend or family member from your social media network sends you a message to sign up to participate in a “fun program”. You just need to provide your personal information such as contact information and address, (FYI since 2017 raw personal data is worth more than raw oil) along with personal information of a few of your friends and information of other gift exchange participants. After doing so, you would have to send a gift to one of the “other gift exchange participants”. At the end of it all, you “gifted a stranger” something and added to a list of personal information, which most likely will be sold to other scammers to try to take from you. You can read more about them here: Social Media Gift Exchanges

3. Holiday Smart Device Applications (Apps)

The Apple App Store and the Google Play store have lots of interesting apps and one can easily fall into the rabbit hole of apps that you may deem of use, but how many of the apps you already have downloaded do you already use on a consistent basis? What data is being collected from you? Some apps require you to purchase them before you download. Typically when paying for an app, you won’t be seeing much or even any advertisements from within the app. However, free apps tend to have an overwhelming amount of advertisements, collect data and habits of the user and more often than not, force users to watch a “short video” to either claim in-app currency or continue to play/participate with the app. There are some situations in which the advertisements are inappropriate to younger users. So how does all this information tie in to our list? Well there are numerous holiday-themed apps which are aimed at children, these apps “provide” youth the opportunity to video chat live with Santa Claus, watch Mr. Claus feed his reindeer live, monitor his sleigh’s location on Christmas eve and even share their holiday wish lists to the north pole. Make sure to update your smart devices to require a password to allow app downloads, thus forcing your little ones to ask for your permission which in-turn allows you to read reviews and make the final call of approval. To read more about holiday apps, click here: Holiday Apps

4. Alerts About Compromised Accounts

These days everyone has a digital subscription or consumer relationship with a tech giant or two or three or more. Since the shift to digital, scammers have been posing as big businesses and either calling, texting or emailing in regards to the recipients accounts being compromised. No matter how you receive this notification, the scammer will use the company’s logo, colors and language to try and create an official alert. What follows, is a link to a website posing as the legitimate company that may ask you to log in using your account number, username/password and even your social security number. Entering this information could cause you to be a victim of fraud, especially when your private information has been given to the scammer. If you receive a call and something seems off about the situation, its best to hang up and call the company through a number that is from a legitimate source. There are even tactics that allow scammers to call under a number that the company may use. If you receive such text or email communication, rather than following any links, go to the organizations legitimate website and find their contact information to verify your accounts status. To read more about compromised accounts, click here: Compromised Accounts Scams

5. Gift Cards

There are a handful of websites and online vendors which sell gift cards legitimately, but as with everything, there are always a few bad apples waiting to be picked. When buying online, verify the website you are using is legitimate, it is always best to buy directly from the merchant’s website. There are also websites that claim to check your gift card’s balance. While convenient in hindsight, there is a possibility of the site taking your gift cards information, especially if they ask for your PIN/security code for your card. A solution would be to check the balance inside a major grocery store chain. Even when purchasing a gift card in-store, there are some important things to keep an eye out for; are any sensitive numbers (like the PIN/security number) exposed? Are there any tears or physical signs of tampering anywhere on the packaging of the card? To read more about gift cards, click here: Gift Card Scams

6. Temporary Holiday Jobs

The holiday season always brings the opportunity to find work. This year, with the combination of supply chain issues and everyone trying to order their gifts in time for the holidays, delivery and shipping services are the top holiday employers. These jobs which may be seasonal often provide the opportunity to employ for the long term. So with this in mind, scammers use the avenue of employment opportunity to steal important personal information from people looking for work. There are numerous tactics used by scammers, some are asking prospective employees to provide payment for job supplies, application, background check and/or training fees. This payment is what they take from you. You should never have to pay and the company should be able to provide resources not the other way around. Another popular scammer tactic is “employers” claiming to pay big amounts of money for “simple” office tasks. These situations are often scammers trying to collect masses of personal information, which may result in some fraud further down the line. To read more about temporary holiday jobs, click here: Temporary Holiday Jobs

7. Look-Alike Websites

Scammers impersonating websites have continued to be a convincing method in which people fall for. Similar to number one on this list (Misleading Social Media Ads), these fake websites are made to look like the legitimate company’s version, such as having the same layout as the legitimate counterpart but with the intention of having unsuspecting people make a payment or even trick people into downloading malware onto their personal computers. To learn more about look-alike websites, click here: Look-Alike Websites

8. Fake Charities

According to the Better Business Bureau, did you know 40% of all charitable donations are done within the last few weeks of the year? With the abrupt transition to using digital services stemmed from the pandemic, many charitable organizations have shifted from in-person fundraising to directing donors to help make a difference via online drives. It is recommended to avoid making donations to unfamiliar organizations online unless you can verify it is from a reliable and legitimate organization. To learn more about fake charities, click here: Fake Charity Scams

9. Fake Shipping Notifications

Due to the never ending status of current events, most shoppers have been keeping all in-person activities down to a minimum and have completed their holiday purchases via their favorite online retailers. Doing so, has brought in an influx of scammers sending out “notifications” regarding shipping details and updates. These are phishing attempts which have unsuspecting victims click on malicious links that permit unwanted access to your device and access to your personal information. To learn more about fake shipping notifications, click here: Fake Shipping Notification Scams

10. Fake Pop-Up Holiday Virtual Events

Many local holiday themed events and activities have shifted to online video based events. This means more and more social media event posts and emails. Scammers have been replicating online content to promote an online event that charges to attend. Scammers “charge” for holiday virtual events with the goal of acquiring credit card information to steal. These type of events are legitimate if organized by a city’s community development department, which provides an avenue to verify the event via their direct online website(s). Local community events hosted officially by cities more often than not, do not charge to attend/participate. To learn more about pop-up holiday virtual events, click here: Pop-Up Virtual Holiday Scams

11. Top Holiday Wish-List Items

One doesn’t need to search online for long to find what has been a sought-after item this holiday season. The latest gaming consoles, designer apparel and toys have been sought after from the start of the pandemic and have provided a crooked opportunity for scammers to “sell” these hot items online. Many reports from the BBB Scam Tracker show consumer complaints regarding phony deals and the inability to contact the seller after making their purchase online. To learn more about how the top holiday wish list items scams work, click here: Top Holiday Wish List Items Scams

12. Puppy Scams

During the pandemic, many have looked into adding a four legged furry friend to their family, unfortunately this new demand has put an extremely competitive search online. As with any other trends, scammers are taking advantage by claiming to sell puppy’s and trying to have people send over money before even seeing how the supposed pups look. Be extra vigilant when you come across any type of pet advertisements, the Better Business Bureau shares 80% of online pet ads may be fake. It is recommended to visit the legitimate website of your local animal shelter to search for any available animals up for adoption. Vaccines are typically given to animals in shelters so it would be one less thing for you to worry about. To learn more about puppy scams, click here: Puppy Scams

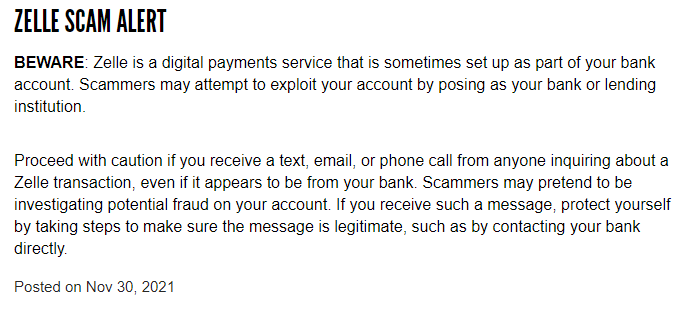

To provide a real world example of just how close to home these above mentioned scams can get, below we have a local press release from the Alameda County District Attorney, Nancy E. O'Malley:

This unfortunate real world event falls under number 4 from our list above, Alerts on Compromised Accounts. To read directly from the District Attorney's website, click here: Alameda Zelle Scam Alert

To learn more preventative tips for staying safe while browsing the internet, visit the Better Business Bureau's website and stay informed of what scams are affecting your community and the communities around you by using the BBB Scam Tracker.