As the holiday season approaches, it’s fun to get swept up in the festive spirit and the joy of giving. However, it’s also a time when our wallets can feel the strain of gift-giving, holiday feasts, and family getaways.

This year your financial wellness doesn’t have to take a holiday break. Getting your money in holiday mode might just increase the merriment.

About 40% of holiday shoppers said inflation is changing the way they shop, with most trying money-saving strategies, according to a recent Bankrate.com report. It’s tempting to get wrapped up in the commercialism of the season, but overspending can place a financial strain on individuals and families well into the new year, and beyond. To make your money go into holiday mode, consider rethinking your holiday plan, setting a budget and sticking with it.

Shared below are do-able ideas to avoid excess holiday debt and celebrate the season in a budget-conscious way:

Get A Handle On Existing Debt

Existing debt can be especially stressful to a household’s overall financial picture during the holidays. Some tips to reduce the stress of debt include knowing how much you owe. Before the holiday events kick in, write down the total amount of all your debts, monthly payments, interest rates and due dates. Limit credit card use as part of holiday spending as much as possible.

Our partners at GreenPath can work with your creditors to consider a Debt Management Plan which helps you pay off unsecured debt in 3 to 5 years. GreenPath can work with your creditors to bring your accounts current, lower interest rates, and eliminate fees. More of your payment goes toward reducing your account balance and you save money on interest.

Create A Holiday Spending Plan

Write down a holiday budget that includes all planned spending – food, décor, travel, gifts, etc. This can help you see how much income you’ll need, set spend limits, and relieve uncertainty and financial stress. Even the most basic holiday spending plan can help you limit impulse purchases.

Minimize Financial Stress

The biggest stressor GreenPath counselors hear from callers is fear of the unknown. Callers are concerned about uncertainty with expenses, keeping up with housing costs, and managing debt as an example. GreenPath’s caring counselors can help you understand financial options in clear terms. When it comes to housing, for instance, counselors can call the lender on a three-way call, ask the correct questions and find out what options are available. Because the foreclosure process varies by state, and options exist that may allow clients to slow or suspend foreclosure activity, sharing a timeline with clients assists with their next action steps and path forward to relieve stress and get back on track.

Supplement Your Income

Is it possible to take on additional work to help offset holiday expenses? Consider gig work through DoorDash, Uber, Lyft or other delivery services. Take advantage of seasonal work opportunities to help finance holiday spending.

Simplify The Season

This year, consider simplifying celebrations and find alternative ways to revel in the season. Resist the urge to splurge on decorating and large parties and choose to gather with family and friends without breaking your budget. As gas and grocery prices are expected to increase, rethink the elaborate (and costly) holiday dinner and invite your loved ones to ‘meet in the middle’ for a more informal get-together. In lieu of hard-to-get items, gift an experience, a family portrait or an online class. Open a 529 savings plan for the kids – the gift that gives long-term.

Volunteer in Someone's Name

Celebrate those you love by giving back. Volunteer at a friend or loved one’s favorite charity or provide a contribution on their behalf. Gift some elbow grease at a local Meals-on-Wheels, community center, humane society, or nonprofit organization that could use your help.

Set Expectations

Thanksgiving gatherings could be the time to communicate this year’s holiday plan. Such conversations can relieve stress for all involved and avoid undue disappointment. A recent survey shows that small children thrive in environments with fewer toys. Research shows that clutter can impact mental well-being in adults, particularly women, and possibly spark increased levels of cortisol, a stress hormone.

Shop Smart

There is time this season to monitor sales for the best deals. Should you use credit this holiday season, look for zero or low-interest payment options. If shopping online, in-store pickup may cut down on shipping costs. Look out for holiday shopping scams and leverage fraud protection via PayPal and credit cards. By “abandoning” your online shopping cart for 24-72 hours, the retailer may grant you a discount or perk through email or other online notifications.

Financial Resources

In all, it is possible to get your money in holiday mode – even with inflation and rising interest rates. It makes sense for households to be especially thoughtful about where each holiday dollar goes.

The national nonprofit GreenPath Financial Wellness offers trusted resources to help people get their money in holiday mode, despite a challenging time. Take a look at the numerous financial health resources on this website to get you through the holidays.

This Information is brought to you by our partners at GreenPath Financial Wellness

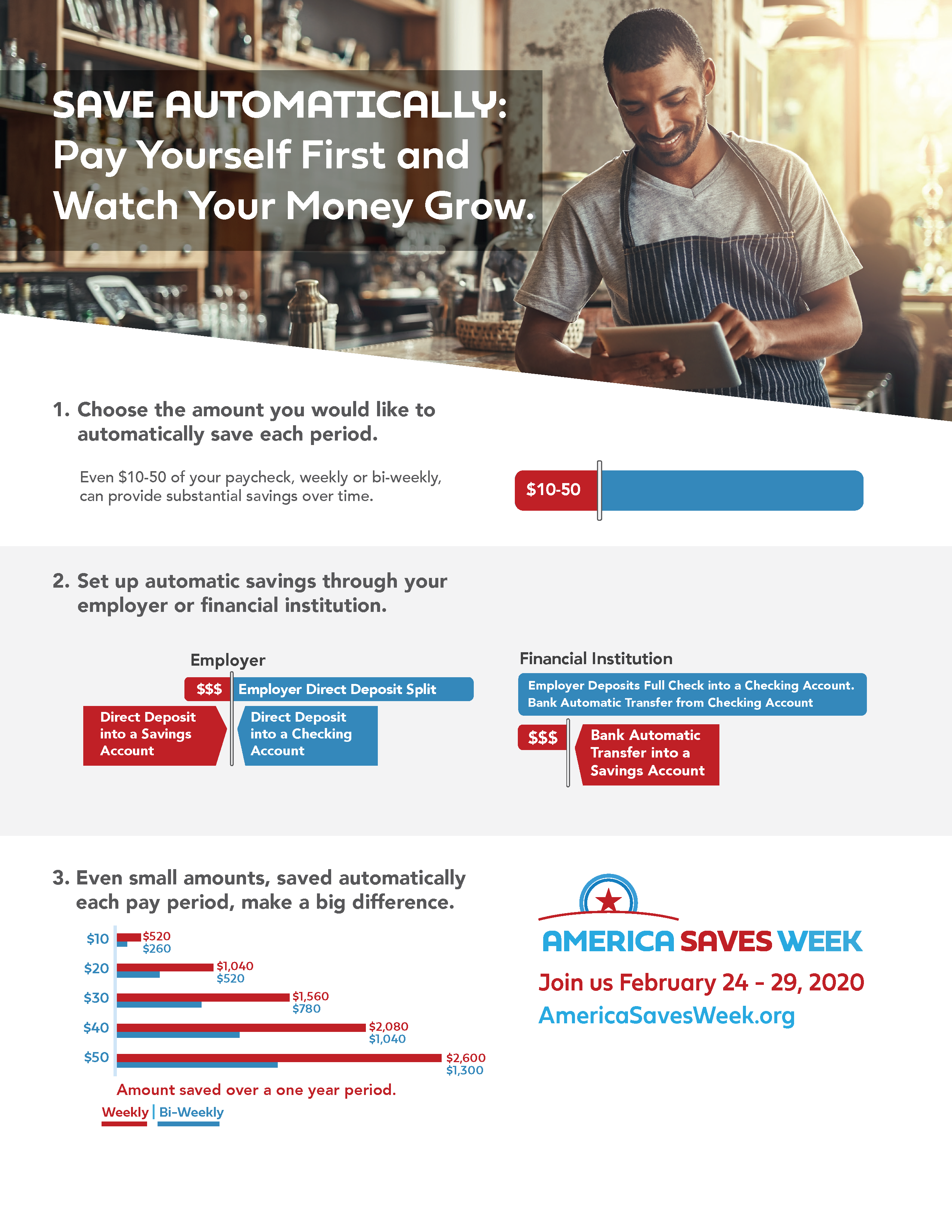

How do you save automatically? The two best ways to

How do you save automatically? The two best ways to