When reading about credit cards, mortgages, or other financial products, you may encounter financial terminology and acronyms that you aren’t familiar with. Please note, these descriptions are a guide only and are not legal definitions.

A

Adjustable-Rate Mortgage

An adjustable-rate mortgage (ARM) is a mortgage that offers the borrower a fixed interest rate for a set amount of time. After that time expires, the interest rate on the remaining balance varies though out the life of the loan. Depending on the terms of the mortgage, the interest rate resets each month or year. This type of mortgage is also called a variable rate mortgage.

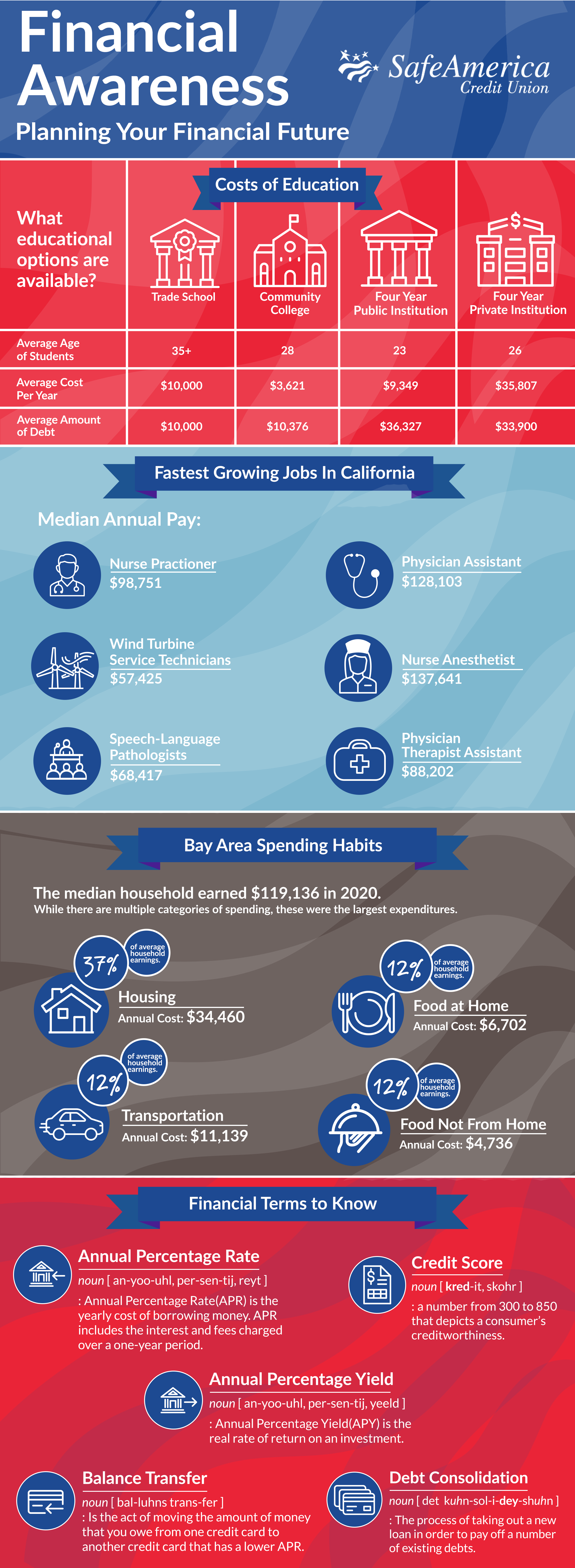

Annual Percentage Rate

The Annual Percentage Rate (APR) is the yearly cost of borrowing money. APR includes the interest and fees charged over a one-year period. Many types of debt include an APR such as credit cards, auto loans, mortgages and personal loans. The APR helps borrowers choose credit card offers, mortgages, loans, etc.

B

Balance

When referring to debt, a balance is the amount of money remaining to be repaid on a loan, credit card or mortgage. When the term "balance" refers to a checking or savings bank account, the balance is the amount of money present in the account.

Balance Transfer

A balance transfer refers to moving a balance from one account to another account, which is often an account at another financial institution. It most commonly describes transferring outstanding debt owed on a credit card to an account held at another credit card company.

Balloon Payment

A balloon payment is the money owed on a loan when the loan term expires (usually after 5-7 years). When the term is over, the borrower must pay a balloon payment for the total amount remaining on the loan, or the borrower can choose to refinance the loan for new terms and rates. Balloon loans sometimes allow the borrower to transfer the remaining amount automatically into a long-term mortgage.

Bankruptcy

When an individual or a company has debt that cannot be repaid, declaring bankruptcy gives the individual or company legal protection from the debts. Bankruptcy is a legal process that can offer relief from some or all debts, depending on the type of bankruptcy.

Budget

A budget is written plan that tracks monthly expenses and income. It is used to help manage finances, keep current with expenses and save money.

C

Card Holder

A card holder is the person who is issued a credit card, along with any authorized users. The primary card holder is responsible for credit card payments. Credit card holders are protected by the federal lending laws which protect consumer rights.

Cash Advance

A cash advance is a loan issued from a creditor. The most common cash advances are issued by a credit card or through a loan taken in advance of a paycheck. These types of cash advance loans charge special interest rates and fees on the amount of the advance.

Cash Advance Fee

A cash advance fee is a charge made by the bank or financial institution that the borrower owes after taking a cash advance loan. This fee could be either a one-time, flat fee that is owed at the time of the transaction or a fee charged as an annual percentage of the amount of the cash advance. Did you know SafeAmerica waves cash advance fees on our Visa Credit Cards? Click here to learn more.

Collateral

Collateral is an asset that a lender accepts as a security for a loan. If a borrower defaults on their loan payments, the lender has the right to seize the collateral and sell it to recoup any losses.

Collections

Collections occur when a creditor, or a business, like a utility company, sells past-due debt to an agency to recover the amount owed. The delinquent debt could be past due credit card debts, utility charges, medical bills, cell phone bills or other payments that are over 6 months past due. Collection agencies attempt to recover past due debts by contacting the borrower via phone and mail.

Conventional Mortgage or Loan

A conventional mortgage or conventional loan is available through a private lender or two government-sponsored enterprises-Fannie Mae or Freddie Mac. Conventional loans are considered risky because they are not guaranteed by the government. These mortgages can have strict requirements and higher interest rates and fees.

Credit

Credit refers to the money that is borrowed that the borrower will need to repay.

Credit Card Charge-Offs

Occurs when a borrower does not pay the full minimum payment on a debt for several months. At that time, the creditor writes it off as bad debt. Note that a credit card charge-off does not absolve a borrower of responsibility for the debt. Interest is still owed on the balance. even after a credit card charge-off, the lender could turn over the account to a collections agency.

Credit History

A person's credit history develops as they borrow, repay and manage their loan payments, expenses and other transactions. Future loans depend on a solid credit history, because lenders check this information.

Credit Report

A credit report is a statement that has information about a person's credit history, including loan paying history and the status of credit accounts. Lenders use credit reports to help them decide if they will loan money and what interest rates they will charge.

Credit Score

A credit score is a number based on a formula using the information in a person's credit report. The result is an accurate forecast of how likely that person is to pay bills or repay loans. Lenders use credit scores to determine what interest rate they will offer on credit cards, mortgages, car loans and other loans.

Creditor

A creditor is a person or institution that extends credit by lending a borrower money. The borrower agrees to repay the funds under the agreed upon terms.

D

Debt

Debt is money owed to a lender, such as debt from credit cards, student loans, or a mortgage.

Debt Consolidation

Debt Consolidation means that a person's debts, whether credit card bills or loan payments, are rolled into a new loan with one monthly payment, A debt consolidation loan does not erase debt. Borrowers might pay more by consolidating debt into another type of loan.

Debt Management plan

A debt management plan is when an organization works with creditors to reduce a borrower's monthly payment and interest rates. People working through a debt management typically take 3-to-5 years to pay off debt.

Debt Counseling

Borrowers receive debt counseling (also called credit counseling) when a trained credit counselor reviews their personal finances, debt and credit history to help manage financial challenges.

Debt Settlement

Debt Settlement is a process of negotiating with creditors to accept a percentage of the full amount of debt that is charged off or severely delinquent. For-profit debt settlement companies operate to deliver profits to their organization. As part of the for-profit business model, debt settlement employees are often paid on a commission basis, based on the fees they collect from consumers.

Default

A default on a loan occurs when a loan payment is not made by the borrower according to the payment terms of an agreement.

Deferment

A loan deferment is when a lender agrees that a borrower can pause making monthly payments for a set amount of time. Loans that are deferred are not forgiven. The borrower still owes the money and must repay the debt. Deferments are often available with student loans to provide the borrower with a set amount of time before making any payments.

Delinquent

When a borrower is late or overdue on making a payment, such as on payments to credit cards, a mortgage, an automobile loan or other debt, it is called delinquent. People who are delinquent, or late, with making payments may be charged a late fee.

F

Fair Debt Collection Practices Act

The Fair Debt Collection Practices Act is a set of laws that protect consumer rights during the debt collection process.

Fannie Mae

Fannie Mae, the informal name of the Federal National Mortgage Association, is a U.S. Government-sponsored enterprised that buys mortgages from lenders, bundles them intp investments and sells them on the secondary mortgage market. typically, Fannie Mae purchases home mortgages loans from commercial banks or big banks.

Finance Charge

A finance charge is the cost of borrowing money. The cost to a borrower includes interest and other fees. Lenders typically set finance charges as a percentage of the amount borrowed. Some lenders might set a flat fee finance charge.

Fixed Rate

A fixed rate is an interest rate that stays the same for the life of the loan, or for a portion of the loan term, depending on the loan agreement.

Forbearance

Forbearance is a process when a lender agrees to a lower payment or no payment for a temporary period of time. Forbearance is not loan forgiveness. After that time expires, the borrower may face higher payments, accrued interest or an extended loan term.

Foreclosure

Foreclosure is a legal proceeding that happens when a borrower does not make payments on a secured debt. The lender may start legal foreclosure proceedings to seize the property associated with the debt. As an example, default on a mortgage could result in foreclosure and auction of the property.

Freddie Mac

Freddie Mac, the informal name of the Federal Home Loan Mortgage Corporation, is a U.S. government-sponsored enterprise that buys mortgages, combines them with other forms of loans, and sells the debt on the secondary mortgage market. Typically, Freddie Mac purchases home mortgage loans form smaller banks and lenders.

G

Grace Period

A grace period is a set period of time in which borrowers do not have to pay finance charges or interest if they pay balances in full. Revolving credit card lending provides a borrower with a grace period.

I

Interest

Interest refers to the cost of borrowing funds, paid to the lender by the borrower. Interest also means the profit that accrues to those who deposit funds in a savings account or investment.

Interest Rate

An interest rate is the fee lenders charge a borrower, calculated as a percentage of the loan amount. The percentage charged when borrowing money is known as the interest rate.

L

Loan

A loan is sum of money that is advanced to a borrower. The borrower agrees to specified terms such as finance charges, interest and repayment date. Some examples include auto and recreational vehicles loans, home loans, home equity loans, personal loans as well as student loans.

Loan Forgiveness

Loan forgiveness means a borrower is no longer obligated to make loan payments. With student debt loan forgiveness, the borrower must meet criteria such as actively serving in the military, performing volunteer work, teach or practice medicine in certain types of communities, or must meet other criteria specified by the forgiveness program.

Loss Mitigation

Loss mitigation is the process when mortgage servicers work with borrowers to avoid foreclosure.

Loan Modification

Loan modification is when a lender makes a permanent change to loan terms. The modifications could inlcude changing the interest rate, type of mortgage or extending the time to pay the mortgage balance.

M

Minimum Payment

The minimum payment is a payment made on a loan or credit card that is specified by the lenders as the smallest payment amount due. Borrowers can pay more than the minimum payment.

Mortgage

A mortgage is the loan a borrower takes in from a lender to purchase real estate.

P

Past Due

Past due is when a payment has not been made by its due date. Borrowers who are past due will usually face penalties and are subject to late fees.

Private Mortgage Insurance

Private mortgage insurance is a type of mortgage insurance that might be required for borrowers to pay for with a conventional loan. Private mortgage insurance protects the lender in the event a borrower stops making payments on the loan.

R

Reinstatement

Reinstatement refers to a lump sum payment that makes an account current when the borrower pays everything that is owed. This payment would include any missed payments and fees.

Refinance

Refinancing applies to all types of loans, this simply means you are replacing any existing debt and terms with a new set of debt and terms, most often with a lower interest rate than the original loan rate.

Repayment Plan

A repayment plan is a written agreement for borrowers who are past due on loan payments. This option allows the borrower to pay the late amount as a smaller addition to the regular monthly payment, spread out over several months.

Revolving Credit

Revolving credit is when a creditor increases the credit limit to an agreed level as a borrower pays off a debt, such as a credit card. Revolving credit may take the form of credit cards or lines of credit with other lenders.

S

Secured Debt

A secured debt is a loan that allows the lender to seize the asset or collateral used to acquire the debt to repay the funds advanced to the borrower in the event of default. Examples of secured debt are mortgages and auto loans.

Short Sale

A short sale is when a homeowner in financial distress sells property for less than the amount due on the mortgage.

U

Unsecured Debt/Unsecured Loan

Unsecured debt or an unsecured loan is a loan that is not backed by an asset or collateral. It is riskier than secured debt. The interest rate for unsecured debt is normally higher than secured debt.

V

Variable Rate Mortgages

A variable rate mortgage is a mortgage in which the initial interest rate is fixed for a period of time. After that period expires, the interest rate on the outstanding balances varies throughout the life of the loan. Depending on the terms of the mortgage, the interest rate resets each month or year. This type of mortgage is also referred to as an adjustable-rate mortgage (ARM).

As a valued member, we provide you with access to certified experts through our partners GreenPath Financial Wellness who will empower you to eliminate financial stress, get out of debt, increase savings, and achieve your financial goals.

Learn more about starting your journey to financial freedom by clicking on the button below.