ICU Day celebrates the spirit of the global credit union movement. The day is recognized to reflect upon the credit union movement's history, promote its achievements, recognize hard work and share member experience. The 75th anniversary of International Credit Union (ICU) Day is Thursday October 19, 2023.

ICU Day is brought to you by the champions of the credit union movement, The World Council of Credit Unions and the Credit Union National Association (CUNA).

Together we all contribute to helping spread the belief of all people having access to affordable, reliable and sustainable financial services for all our members, meeting them at their financial terms.

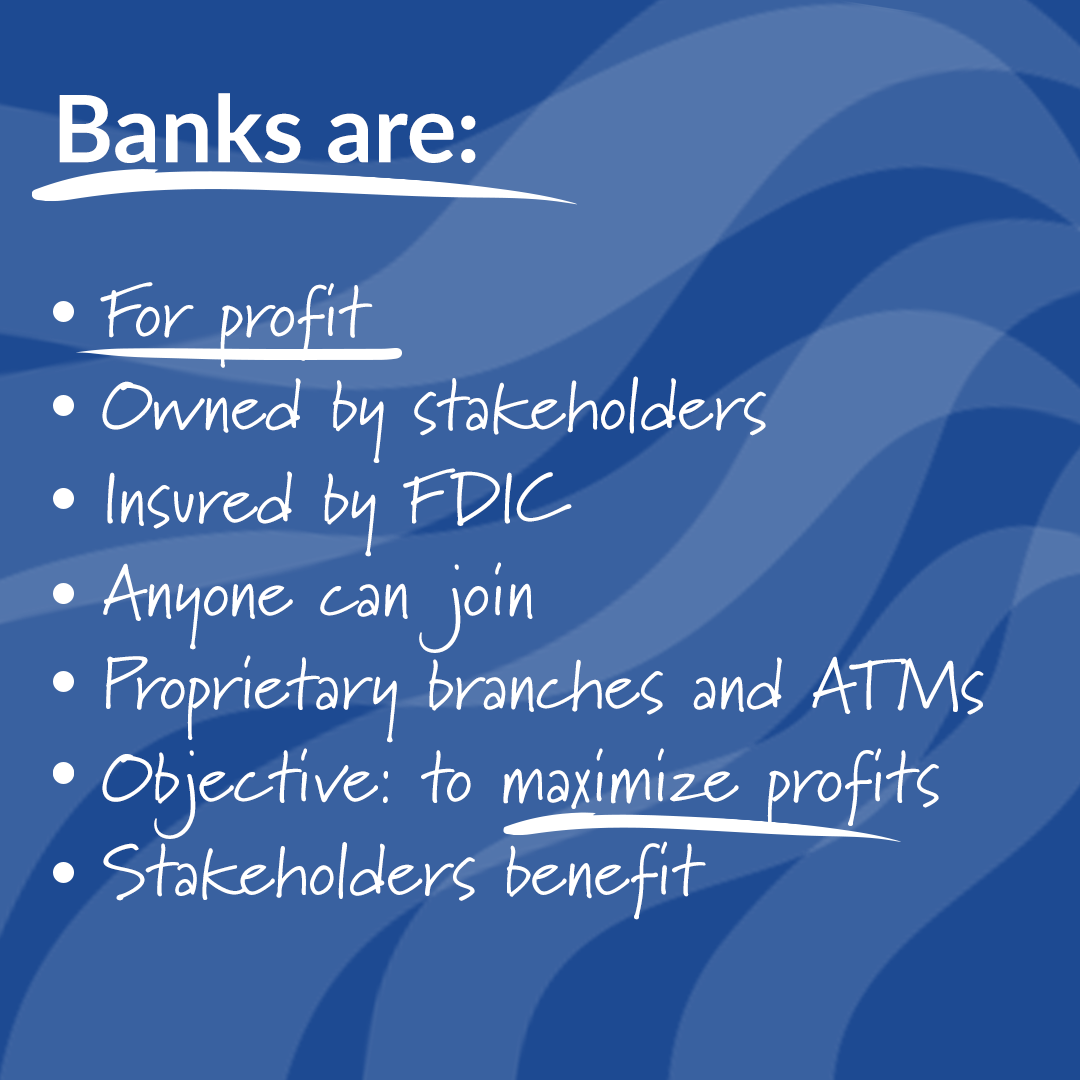

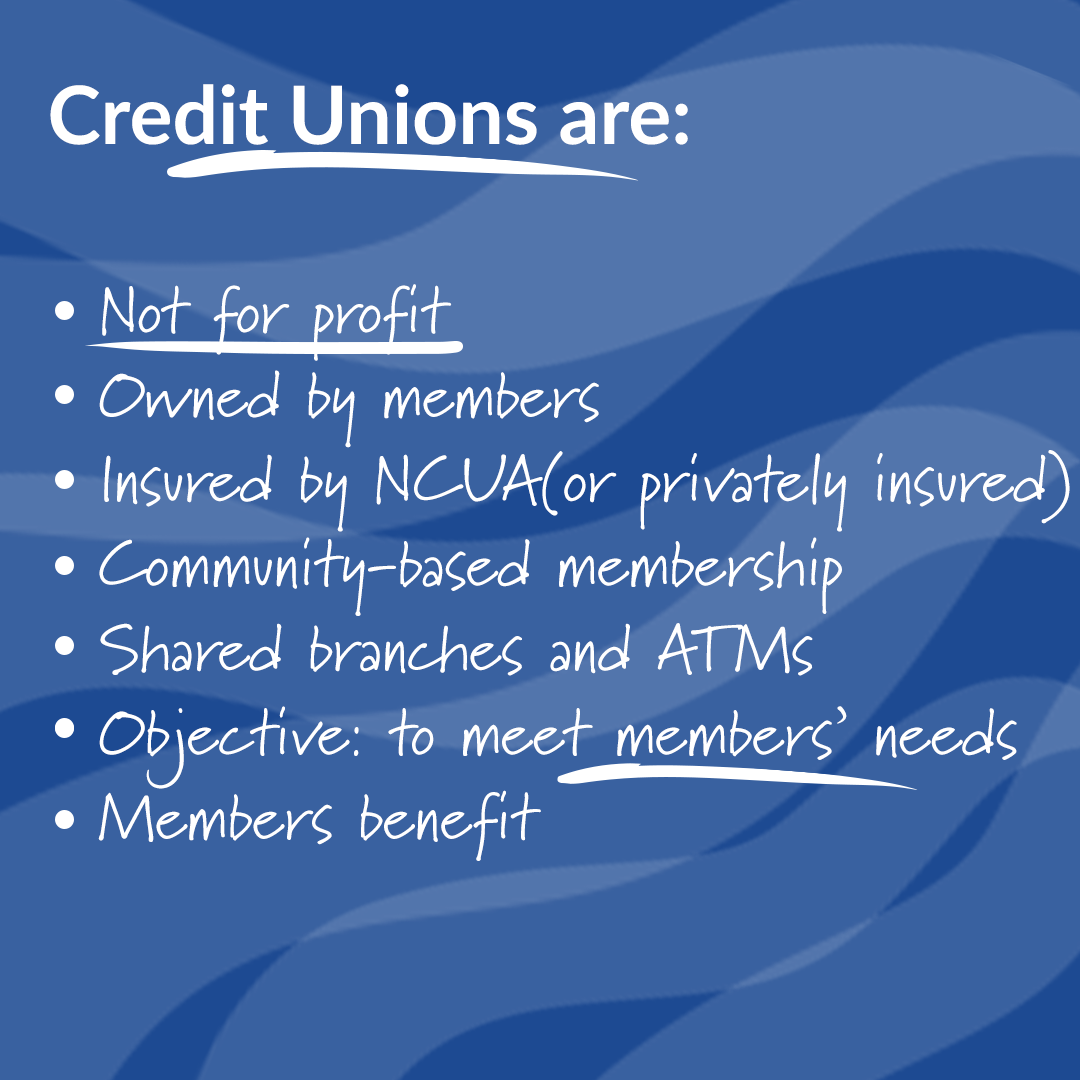

Ever Wonder What The Differences Are Between Credit Unions And Banks? Here's How They Are Different.

Credit Union Fun Facts

- There are 118 countries with credit unions.

- Worldwide, there are a total of 87,914 credit unions.

- Throughout the world there are 393,871,631 members.

- The first true credit unions were established in Germany in 1852 and 1864.

- President Roosevelt signed the Federal Credit Union Act in 1934 to promote thriftiness and prevent usury during the Great Depression.

- Credit union membership eligibility is pretty flexible and open to most based on where you live.

- Credit union members are entitled to vote for their board members or directors.

- Credit unions are able to offer better rates and lower/fewer fees than banks.

- Many credit unions participate in shared branches and ATMs, which means you can visit other participating credit unions for access to your accounts, making it a larger network than most big banks.

- Once you're a member, you're always a member, regardless of where you live.

- All credit unions require you to have a share (savings) account. Even if you only want a loan. It acts as your "share of ownership".

What is a Credit Union?

Celebrating 75 Years!

Thank you!

We'd like to take this opportunity to thank you, our valued members, who help make SafeAmerica Credit Union what it is today.